Introduction to Blockchains & What It Means to Big Data

What is a Blockchain?

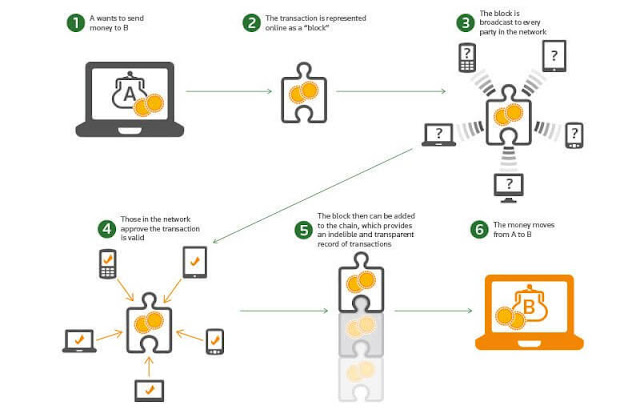

Blockchain is a distributed database system that acts as an “open ledger” to store and

manage transactions. Each record in the database is called a block and contains

details such as the transaction timestamp as well as a link to the previous

block. This makes it impossible for anyone to alter information about the records

retrospectively. Also, due to the fact that the same transaction is recorded

over multiple, distributed database systems, the technology is secure by

design.

With the above in mind, blockchain is immutable –

information remains in the same state for as long as the network exists.

Blockchain

and Big Data

When you talk about blockchain in the

context of Bitcoin, the connection to Big Data seems a little tenuous. What if,

instead of Bitcoin, the blockchain was a ledger for other financial

transactions? Or business contracts? Or stock trades?

The financial services industry is

starting to take a serious look at block chain technology. Citi, Nasdaq, and

Visa recently made significant , a Bitcoinblockchain service provider. And

Oliver Bussmann, CIO of UBS says that blockchain technology could “pare

transaction processing time from days to minutes.”

The business imperative in financial

services for blockchain is powerful. Imagine blockchains of that magnitude.

Huge data lakes of blocks that contain the full history of every financial

transaction, all available for analysis. Blockchain provides for the integrity

of the ledger, but not for the analysis. That’s where Big Data and accompanying

analysis tools will come into play.

OPPORTUNITIES FOR BIG DATA ANALYTICS

Recently, a consortium of 47 Japanese

banks signed up with a

blockchain startup called Ripple to facilitate money transfers between bank

accounts using blockchain. The main reason behind the move is to perform

real-time transfers at a significantly low cost. One of the reasons traditional

real-time transfers were expensive was because of the potential risk factors.

Double-spending (which is a form of transaction failure where the same security

token gets used twice) is a real problem with real-time transfers. With

blockchains, that risk is largely avoided. Big data analytics makes it possible

to identify patterns in consumer spending and identify risky transactions a lot

quicker than they can be done currently. This reduces the cost with real-time

transactions.

In Industries outside of banking too,

the main drive for adoption of Blockchain technologies has been security.

Across healthcare, retail and public administration, establishments have

started experimenting with blockchain to handle data to prevent hacking and

data leaks. In healthcare, a technology such as blockchain can make sure that

multiple “signatures” are sought at every level of data access. This can help

prevent a repeat of events such as the 2015 attack that led to the theft

of over 100

million patient

records.

POSSIBILITIES IN REAL-TIME ANALYTICS

Up until now, real-time fraud detection

has only been a pipe dream and banking institutions have always relied on using

technologies to identify fraudulent transactions retrospectively. Since the blockchain

has a database record for every single transaction, it provides a way for

institutions to mine for patterns in real-time, if need be.

But all of these possibilities also raise

questions about privacy and this is in direct contradiction to the reason why

blockchain and bitcoins became popular in the first place. Several industry

experts have expressed

concerns that

a technology that can provide a record of every transaction can be exploited

for everything “from customer profiling to other less benign reasons”.

From another perspective however,

blockchains greatly improve transparency in data analytics. Unlike previous

algorithms, the blockchain design rejects any input that it can’t verify and is

deemed suspicious. As a result, analysts in industries such as Retail only deal

with data that is completely transparent. In other words, the customer behavior

patterns that blockchain systems identify are likely to be a whole lot more

accurate than it is today.

Uncovering transactional data

The data within the blockchain is

predicted to be worth trillions of dollars as it continues to make its way into

banking, micropayments, remittances, and other financial services. In fact, the

blockchain ledger could be worth up to 20% of the total big data market by 2030,

producing up to $100 billion in annual revenue. To put this into perspective,

this potential revenue surpasses that of what Visa, Mastercard,

and PayPal currently generate combined. Big data analytics will be crucial in

tracking these activities and helping organizations using the blockchain make

more informed decisions.

Data intelligence services are emerging

to help financial institutions, governments, and all kinds of organizations

delve into who they might be interacting with on the blockchain and uncover

“hidden” patterns.

Uncovering social data

As the popularity of bitcoin advanced

in 2014 and 2015, the virtual currency began to fluctuate heavily as a result

of real-world events and the general public’s sentiment about the technology.

These fluctuations are proof that the virtual currency has several

characteristics that make it ideal for social data predictions.

According to Rick Burgess of Freshminds: “Using social

data to predict consumer behavior is nothing new, and many traders have been

looking to include social metrics into their trading algorithms. However,

because there are so many factors involved in pricing most financial

instruments, it can be extremely difficult to predict how markets will change.”

Fortunately, bitcoin users and social

media users tend to align quite well, and it may be beneficial to use them both

for data analysis, as he

further explains:

·

Bitcoin users tend to be in the same

demographic as social media users, and so their attitudes, opinions, and

sentiment towards bitcoin are well documented.

·

The value of bitcoins and other

cryptocurrencies are determined almost

solely by market demand because the number of coins on the market is

predictable and are not tied to any physical goods.

·

Bitcoins are predominantly traded by

individuals rather than large institutions.

·

Events that affect Bitcoin's value are

disseminated first and foremost on social media.

Data analysts are now mining social data for insights

into key cryptocurrency trends. This, in turn, helps organizations uncover

powerful demographic information and link bitcoin’s performance to world

events.

Uncovering new forms of data monetization

According to Bill

Schmarzo, CTO of Dell EMC Services, blockchain

technology also “has the potential to democratize the sharing and monetization

of data and analytics by removing the middleman from facilitating

transactions.” In the business world, this gives consumers stronger negotiating

powers over companies. It allows consumers to control who has access to their

data through the blockchain. They could then demand pricing discounts in

exchange for revealing data on their personal consumptions of a company’s

product or service.

Schmarzo also explains how the blockchain may lead to new forms of data

monetization because it has the following big data ramifications:

·

All parties involved in a transaction

have access to the same data. This accelerates data acquisition, sharing, the

quality of data and data analytics.

·

A detailed register of all transactions

is kept in a single “file” or blockchain. This provides a complete overview of

a transaction from start to finish, eliminating the needs for multiple systems.

·

Individuals can manage and control

their personal data without the need for a third-party intermediary or

centralized repository.

Ultimately, the blockchain could become

a key enabler of data monetization by creating new marketplaces where companies

and individuals can share, sell, and offer their data and analytical insights

directly with each other.

Spearheaded by the large scale adoption

of bitcoin, blockchain technologies are gaining ground throughout the business

and financial worlds. The fast and secure transactions it facilitates could

potentially revolutionize traditional data systems. According to a survey

by KPMG and

Forrester Consulting, one-third of decision makers trust their company’s data. But with

blockchain technologies, this trust can be considerably strengthened, and real

applications will become much more commonplace.

Comments

Post a Comment